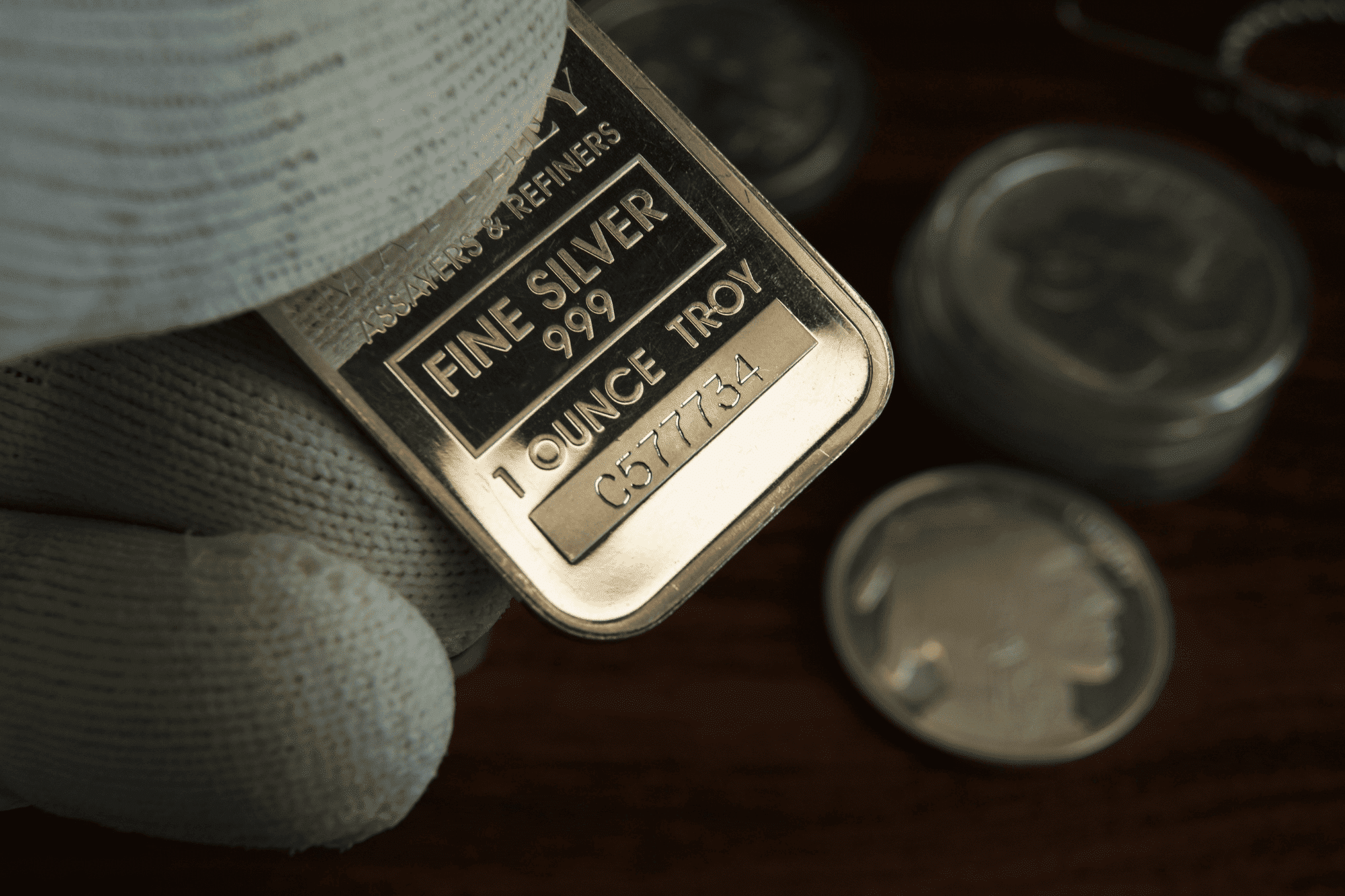

Silver has returned to the spotlight as one of the most compelling investment metals. After breaking above $60 per ounce, the strongest 12-month rally since 1979, both industrial demand and investment interest are fueling its momentum. Here’s what you need to know about silver’s future and whether it’s the right time to invest.

Why Silver Prices Are Surging

- Historic Rally: Silver has experienced a nearly vertical price increase, surpassing previous peaks in 2008 and 2020.

- Industrial Demand: Silver is critical for solar panels, EV batteries, semiconductors, medical devices, robotics, and advanced electronics.

- Investment Demand: Hedge funds, retail investors, and sovereign wealth funds are increasingly allocating to silver as a safe-haven asset.

- Supply Constraints: Mining output cannot keep up with growing demand, and most silver is produced as a byproduct of gold, copper, and zinc mining.

Market Dynamics in 2026

- Volatility Expected: After record highs in 2025, pullbacks and price consolidation are likely before the next upward trend.

- Industrial Demand Factors: Photovoltaic (PV) demand may slow due to policy changes, particularly in China, and high prices are pushing manufacturers to reduce silver usage per module.

- Jewelry and Silverware: High prices have reduced demand, notably in India, a major market for silver jewelry and silverware.

- Investment Support: Silver ETFs, coins, and bars remain critical for demand growth, with holdings rising significantly in 2025.

Long-Term Drivers (2025–2030)

- Industrial Growth: Over half of global silver demand comes from industrial applications, including solar, EVs, 5G electronics, AI data centers, and batteries. Advanced solar technologies require up to 50% more silver than older models.

- Persistent Supply Deficits: Recent deficits are estimated at 115–120 million ounces per year, and mining expansion is slow due to silver’s byproduct status.

- Macro Trends: Low real interest rates, rising inflation concerns, and increasing global debt push investors toward tangible assets.

- Investor Psychology: Silver benefits from both economic uncertainty and technological growth, attracting retail and institutional investors alike.

Silver Price Forecasts 2025–2030

- Near-Term (2025–2026):

- UBS: $42–55/oz

- Bank of America: ~$65/oz

- Citi: ~$42/oz (possible correction)

- UBS: $42–55/oz

- Long-Term (2027–2030):

- InvestingHaven: $77–82/oz

- LiteFinance: $133–143/oz, with extreme scenarios exceeding $200/oz

- Mike Maloney: potential $100+ by 2030

- InvestingHaven: $77–82/oz

Is Now a Good Time to Buy Silver?

- Dollar-Cost Averaging: Buying silver regularly is a practical way to reduce timing risk.

- Portfolio Allocation: Conservative: 2–5%, Moderate: 5–10%, Aggressive: 10%+ in physical silver, ETFs, or mining equities.

Investment Rationale: Strong industrial demand, ongoing supply deficits, and supportive macroeconomic trends suggest the silver bull cycle is still in its early stages.

Key Takeaways

- Silver’s rally is grounded in both industrial demand and investment interest, not just speculation.

- Supply constraints and recycling limits support structurally higher prices.

- Renewable energy growth, EV adoption, and macroeconomic uncertainty favor silver as a hedge and growth asset.

- Investors can consider building positions gradually to benefit from potential long-term gains.