Qatar’s economy is expected to remain resilient to lower oil prices. The international oil market has experienced significant adjustment in recent weeks, with the Brent crude oil price falling 43% from USD115/barrel in June to around USD65/b currently. Oil prices are widely expected to recover gradually once the current supply glut is absorbed. Qatar has ample resources to continue implementing its infrastructure investment programme. The sizeable investment programme should therefore continue to drive non-hydrocarbon growth and lead to further economic diversification going forward.

The fundamental shift that has driven the drop in oil prices in recent weeks has been an upward shift in expectations for a supply glut in 2015, combined with weaker than expected demand, particularly in China. In July, the International Energy Agency (IEA) estimated that the world oil market would be oversupplied by around 0.1m b/d on average in 2015. However, the IEA’s latest report increased its estimate for this supply glut to 1.3m b/d, driven by both lower expectations for demand and higher expectations for supply.

Firstly, lower expectations for oil demand in 2015 are the result of weaker than expected global growth. Projections for oil demand from OECD economies have been revised down by 0.4m b/d since July, reflecting the current recession in Japan and a weaker Eurozone recovery. For Emerging Markets, the economic slowdown in China has led to a downward revision in global demand of 0.3m b/d.

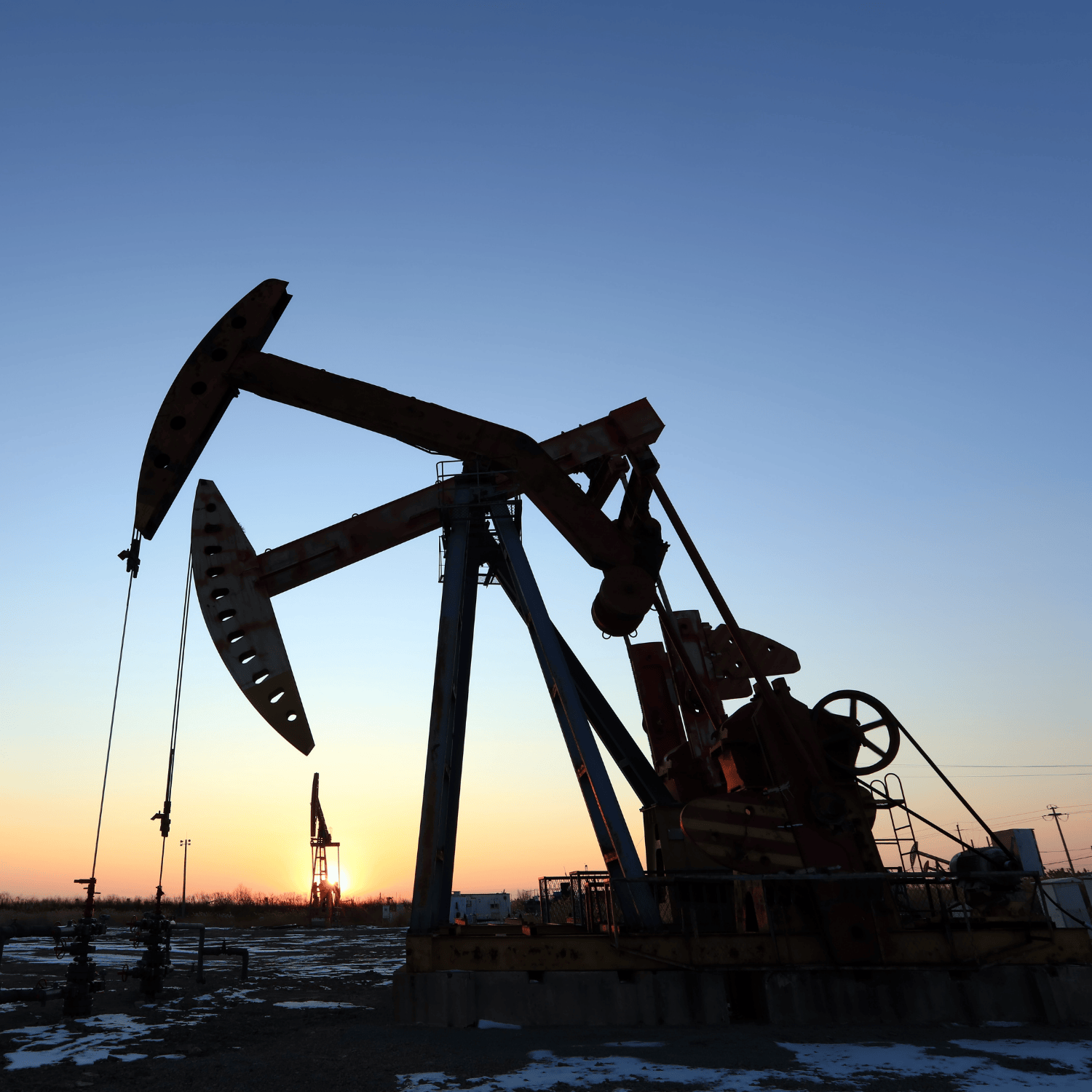

Secondly, on the supply side, expectations for a supply glut are being driven by higher production from OPEC countries and stronger US output. According to the IEA, OPEC production increased by 0.4m b/d in Q3 2014, mainly reflecting resumption in Libya’s production. At its meeting in November, OPEC decided not to cut its current production of 30m b/d, thus reinforcing the expectations of a supply glut in 2015.

Meanwhile, production in the US has been rising faster than expected. The IEA has raised its expectations for overall US production by 0.5m b/d since June. This is mainly the result of new technologies to extract oil from shale rock formations. As a result, total US crude oil production has risen by 67% from an average of 5.6m b/d in 2011 to a projected 9.4m b/d in 2015. Almost all of this increase has come from shale oil fields.

Going forward, oil prices are expected to recover gradually. This is partly because lower oil prices will stimulate greater demand but also because lower prices will discourage investment in new production. The region most at risk of investment cutbacks is US shale oil, where production is more costly than for conventional fields. According to Morgan Stanley, the average cost of US shale oil production is around USD68/b (USD71/b adjusted for Brent-WTI differentials), considerably higher than production costs at conventional oil fields. However, at some shale oil fields, the cost of production reaches close to USD100/b. At current oil prices, a significant share of shale oil production is therefore not commercially viable and at risk of being curtailed.

The adjustment however is expected to take time. A number of projects intended to become productive early in 2015 are too far advanced to be cut back. Furthermore, costs of production are falling and companies may have financial hedges in place or could try to weather the storm in expectation of higher future prices. However, if oil prices remain low, producers with the highest costs are likely to be forced to make cutbacks leading to lower production starting in the second half of 2015. This would reduce oversupply in global oil markets and drive a gradual recovery in oil prices going forward.

The impact of lower oil prices on Qatar is expected to be small. Non-hydrocarbon real GDP growth is expected to continue accelerating as the government implement its ambitious investment programme ahead of the 2022 World Cup. While lower oil prices will inevitably lead to lower hydrocarbon exports and fiscal revenues, the government has ample resources to finance its investment program. As a result, the overall economic outlook remains positive amid a continued drive to diversify the economy and thus reduce reliance on the hydrocarbon sector.

In summary, despite the drop in oil prices over the last six months, we expect a gradual recovery in prices starting in 2015. This is based on supply side adjustments that are likely to occur at oil fields where the cost of production is highest, namely in the US. Even if oil prices fall further, which is not expected, Qatar has the capacity to fully finance its ambitious investment programme.

Source : Qatar News Agency