Modon Holding PSC (“Modon”) delivered exceptional performance in the first half of 2025, with revenue and profitability significantly increasing year-on-year, excluding last year’s one-off items. The results were driven by solid contributions across all four core segments, underpinned by the successful integration of recent acquisitions and execution of strategic investments.

Real estate revenue led Modon’s growth, which was further strengthened by stronger recurring revenue from improved operations across the Asset Management and Hospitality assets, as well as outperformance in the Events, Catering & Tourism segment. The Group recorded landmark real estate sales of AED 10 billion.

Continuing positive momentum as Modon enters H2, the AED 5.5 billion sell-out of the Wadeem community’s residential plots in July has pushed cumulative sales beyond the 2024 total, ensuring a strong start for the second half while further reinforcing Modon’s growing development pipeline and building a strong foundation for long-term value creation.

H1 2025 Group Highlights

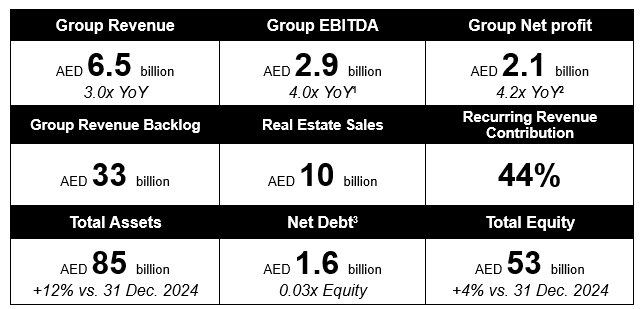

- Group revenue tripled year-on-year to AED 6.5 billion, driven by the recognition of a deepening development backlog which reflects record real estate sales from new launches and existing inventory, improved performance across the recurring revenue portfolio, and contributions from recent acquisitions.

- Group EBITDA reached AED 2.9 billion, rising 4.0x year-on-year, excluding last year’s one-off items, and outpacing revenue growth, with margins expanding to 44%, supported by an enhanced portfolio mix, efficiency gains and integration synergies.

- Group net profit grew 4.2x year-on-year to AED 2.1 billion, compared to AED 502 million in H1 2024, excluding the one-off AED 9.0 billion bargain gain from the 2024 merger and other non-core provisions and unrealised fair value changes. The uplift was underpinned by a strong operating performance across all four core business segments.

- Group revenue backlog amounted to AED 33 billion across all business segments.

- Real estate sales were AED 10 billion, with two launches across flagship Modon masterplans sold out within a day, reflecting strong market demand.

- Recurring income streams strengthened across Asset Management, Hospitality, and Events, Catering & Tourism segments, driven by near-full occupancy across the leasing portfolio, operational expansion, strategic acquisitions, and improved rates and synergies.

- International expansion continued through strategic investments in the United Kingdom and North America, increasing Modon’s operational footprint to 13 countries.

- Operating under Modon, Gridora, a new infrastructure platform was jointly formed with ADQ and IHC and will lead strategic infrastructure projects in the UAE and abroad. In May, Gridora signed an MoU with Abu Dhabi Projects and Infrastructure Centre (ADPIC) to support delivery of ADPIC’s AED 35 billion mandated transport infrastructure programme in Abu Dhabi.

H.E. JASSEM MOHAMMED BU ATABA AL ZAABI

CHAIRMAN OF MODON HOLDING

“H1 2025 marks another pivotal chapter in Modon’s evolution as a diversified international holding group. Exceptional commercial performance and strategic delivery continue to accelerate our transformation, enabling us to scale across high-impact sectors. We remain focused on long-term value creation while reinforcing Abu Dhabi’s position as a global hub for investment, innovation and sustainable urban development.”

H.E. ABDULLAH AL SAHI

GROUP MANAGING DIRECTOR OF MODON HOLDING

“Modon’s performance in the first half of 2025 reflects disciplined execution of our strategic roadmap, supported by strong sales achievements and sustained momentum across our core businesses. Continued expansion into priority markets such as the UK and North America, alongside targeted growth across Egypt and Spain, reflects our commitment to building a future-ready portfolio with global reach. These moves strengthen our asset base and enhance our ability to drive long-term, sustainable value creation.”

BILL O’REGAN

GROUP CHIEF EXECUTIVE OFFICER OF MODON HOLDING

“Our outstanding H1 2025 results demonstrate the strength of Modon’s diversified operating model and our ability to deliver at scale. Revenue and EBITDA grew significantly, driven by high-demand real estate launches, stable recurring income and disciplined capital deployment. Record sales of AED 10 billion and a robust development pipeline reinforce forward visibility, while key milestones – the acquisition of a global leader in large-scale temporary infrastructure (Arena), our expansion into UK prime commercial real estate and our role in launching Gridora – further position us to lead across priority growth sectors. Looking ahead to the second half of 2025 and into next year, we will continue to execute with discipline and deliver sustainable impact across markets.”

Business Performance by Segment

Modon recorded significant growth across its four key business segments:

- Real Estate: The Group’s primary revenue driver in H1 2025 delivered AED 3.65 billion in top-line, 4.0x prior year, fuelled by sustained sales momentum and backlog recognition. Flagship UAE developments on Reem and Hudayriyat Islands achieved record sales of AED 10 billion, with full sell-outs at the newly launched Muheira and Nawayef Village projects. In parallel, a record AED 10.4 billion in construction and consulting contracts were awarded during the period, a 17.3x increase year-on-year, accelerating the transition from design-stage assets to active, on-the-ground execution. Internationally, Modon has moved forward on its 170.8 million sqm Ras El Hekma project in Egypt, while making strategic progress at Spain’s La Zagaleta estate through land sales, further diversifying and strengthening its global real estate platform.

- Asset & Investment Management: The segmentstrengthened income stability across a diversified portfolio of residential, retail, commercial, staff accommodation, and leisure assets. Consistently high occupancy, rising footfall and rental uplifts supported recurring income growth, with revenue reached AED 320 million in H1 2025, up 23% year-on-year. Investment portfolio repositioning included the divestment of legacy financial assets, as well as the formation of new joint ventures including 2 Finsbury Avenue in London with British Land and GIC and the Gridora infrastructure platform in partnership with IHC and ADQ.

- Events, Catering & Tourism: Robust performance was driven by operational expansion and strategic acquisitions including Arena Events Group, Business Design Centre (BDC), and Royal Catering. Revenue amounted to AED 2.2 billion, 2.7x prior year, supported by scale benefits from recent acquisitions and improved delivery across clusters. The Venues cluster hosted 97 events, attracting 3 million visitors across the four venues (ADNEC Abu Dhabi, Al Ain, ExCel London, BDC London). Key events included International Defence Exhibition and Conference (IDEX 2025), Make it in the Emirates (MIITE) Forum, and the Abu Dhabi International Book Fair at ADNEC, alongside major international events such as KubeCon, Salesforce World Tour and the Food, Drink and Hospitality Week Exhibition at UK venues. The Catering cluster served 23.7 million meals, with growth driven by strong aviation and multi-channel demand.

- Hospitality: As of H1 2025, the Hospitality segment included nine wholly owned hotels totalling 2,097 keys, complemented by three operated hotels with 147 keys and a broader joint venture portfolio of 15 hotels with 4,894 keys. Improvements in average daily rates across the UAE and Egypt supported steady operating performance. Revenue from owned and operated hotels reached AED 359 million, driven by stronger pricing metrics and the addition of Four Seasons Rabat, Morocco in H2 2024.

Strategic Investments & Partnerships

H1 2025 marked continued execution of Modon’s global expansion strategy through high-impact investments and partnerships:

- 2 Finsbury Avenue: Modon acquired a 50% stake in a 750,000 square foot commercial development in London’s Broadgate district, through a joint venture with British Land and GIC. The project enhances Modon’s exposure to institutional-grade real estate in a leading global financial hub.

- Arena Events Group: Modon acquired 100% of Arena, a global provider of event infrastructure and modular venues operating in nine countries. The transaction expands Modon’s footprint into North America and other markets, strengthening its capabilities in the international events and exhibitions space.

- Gridora: Modon launched a dedicated infrastructure platform in partnership with ADQ and IHC, also serving as operational lead. Gridora will support the development of strategic infrastructure projects across the UAE and targeted regional markets. In May 2025, Gridora announced its first major engagement through a partnership with the Abu Dhabi Projects and Infrastructure Centre (ADPIC) to support delivery of ADPIC’s mandated AED 35 billion in transport infrastructure projects across Abu Dhabi.

- Elsewedy LOI: In Egypt, Modon signed a letter of intent with Elsewedy Industrial Development to build and operate a new industrial zone servicing the 170.8 million square metre Ras El Hekma megaproject.

Outlook & Future Growth

Modon enters the second half of 2025 with strong momentum and a clear focus on disciplined execution. Its diversified business model continues to provide resilience, while recent acquisitions and integrations have expanded the Group’s operational scale and strategic reach.

Already in H2, the launch of Wadeem – Modon’s first residential land plot offering on Hudayriyat Island – has generated AED 5.5 billion in sales within 72 hours, with more launches still to be announced. The success of Wadeem reinforces both the strength of the development pipeline and sustained demand for flagship communities, while demonstrating Modon’s capacity for shaping distinctive offerings that meet market demands across unrivalled destinations.

With a robust revenue backlog, rising recurring income and continued asset rotation, Modon is well-positioned to enhance capital efficiency and sustain long-term growth. Key priorities for the second half include advancing the Ras El Hekma launch in Egypt, sustaining performance across Abu Dhabi’s core developments, further activation of the recuring income portfolio, and unlocking synergies across the core segments.

The Group remains focused on timely project delivery, deepening its income base, driving operational excellence, and advancing ESG and digital transformation – supporting its role in delivering Abu Dhabi’s national and global development agenda.