Kuwait Financial Centre “Markaz” Buoyed by strong macroeconomic fundamentals, the real estate sector in GCC economies is on a solid trajectory to witness acceleration in the second half of the year, according to the ‘Real Estate H2 2022 Outlook’ reports for the UAE and Saudi Arabia issued recently by the Kuwait Financial Centre “Markaz.”

The reports also analyse the performance of subsectors such as residential, office, retail and hospitality during the first six months and delve into the impact of various new socioeconomic policies and real estate reforms and initiatives on the sector.

Prepared by Marmore MENA Intelligence, a fully owned subsidiary of Markaz, based on the ‘Markaz Real Estate Macro Index,’ the reports help investors identify the current state of the GCC real estate market through various economic indicators such as oil and non-oil GDP growth, inflation, new job creation, interest rate, and population growth, among others.

The findings and observations in the reports are substantiated with data from the past seven years along with estimates for the remainder of the current year and forecasts for the next year.

The ‘UAE Real Estate Outlook H2 2022’ reveals that the real estate sector in the country has overall been trending upwards this year, with a rise in rentals and property prices. Along with an increase in the prices, transaction volume in the first quarter of the year in Dubai touched its highest total for the first quarter ever recorded in the region. The upward momentum in the national economy fuelled by rising oil prices, growth in the non-oil sector and the success of Expo 2020 Dubai were among key drivers of growth in the real estate sector.

Property prices in the UAE continue their upswing momentum in 2022 with average residential property prices rising in both Dubai and Abu Dhabi by 11.3 per cent and 1.5 per cent respectively in the 12 months to March this year. Office rents for grade A offices in both the cities continue to soar, marking an increase of 9 per cent and 5 per cent respectively Y/Y.

In the retail segment, Dubai has witnessed an average rental growth of 10.5 per cent in the first quarter of 2022, whereas Abu Dhabi witnessed a decline in average rental by 7.8 per cent in the same period. The sector remains positive on the back of increasing demand from new local entrants and international brands. Meanwhile, the hospitality market saw significant growth across all the key metrics including occupancy rates, average daily rate (ADR), and revenue per available room (RevPAR) in the first quarter.

This rapid growth on the back of global events could steady down in the near term but is expected to continue its growth trajectory in the long term.

Based on its assessment of various macroeconomic factors, the report forecasts that the real estate sector in the UAE is expected to accelerate in the second half of 2022. Relatively high rental yields coupled with affordability, friendly visa policies and new work permits that aim to enable qualified workforce to live in the UAE and long-term plans of urban and sustainable development under Dubai Urban Master Plan 2040 are expected to incentivise investors who are looking for a steady stream of income, while measures targeted towards increasing transparency and reporting within the real estate sector and restructuring of government entities to increase efficiency and enhance investor experience are set to boost the investor confidence further.

However, the report notes that the Central Bank of UAE has raised interest rates in lockstep with the US Fed and warns that higher interest rates are expected to affect consumer spending during the rest of 2022 and 2023.

The ‘KSA Real Estate Outlook H2 2022’ shows that the Saudi Arabian real estate market has made a strong recovery from the coronavirus-induced slowdown as demonstrated by the rise in the real estate price index by 0.4 per cent year-on-year (y/y) in Q1 2022, mainly driven by a 1.8 per cent y/y increase in residential land prices. Real estate land prices have been relatively stable in the recent past, showing mild growth.

Various measures taken by the government such as ensuring home ownership for all nationals and mandating regional headquarters for foreign companies have also given new impetus to the real estate sector. In addition, other

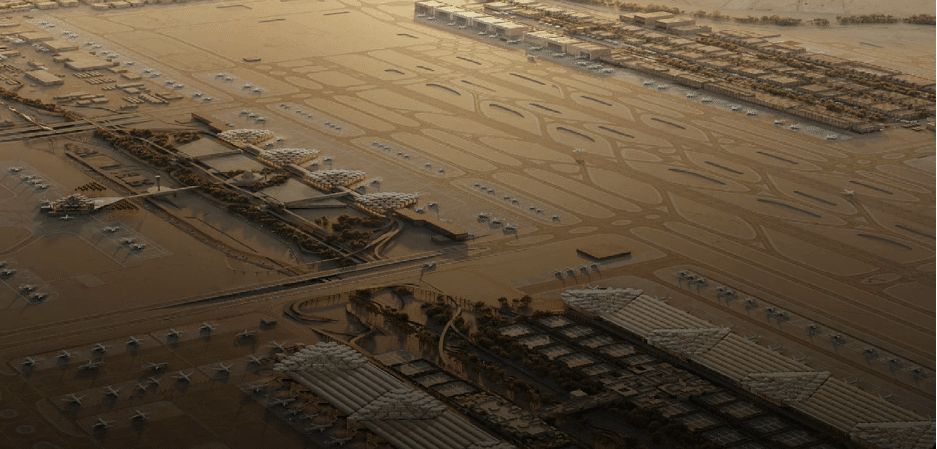

government initiatives such as Sakani, which enables Saudi citizens to own their first home, and the Wafi off-plan sales and rent programme boosted the demand for affordable homes. It also notes that Saudi Arabia’s new giga projects including NEOM, the Red Sea Project, and Riyadh’s Diriyah Gate signal a shift in consumer preferences and real estate development.

Though the real estate price index for Saudi Arabia is still below its 2015 highs, it has stabilized in recent quarters. Residential transaction volumes fell by 23.4 per cent in Q1 2022 vs Q1 2021 and the total value of the transactions also fell marginally by 1.9 per cent. On the other hand, the office sector’s performance improved across the Kingdom in the first quarter of this year, with average rents for Grade A and Grade B office buildings climbing in Riyadh and Jeddah by 8 per cent and 3 per cent respectively. In the retail sector, however, rents for super regional and regional malls declined by 5 per cent and 7 per cent respectively in Riyadh, and by 1 per cent and 5 percent in Jeddah. On the back of rising leisure, business and religious visitation, the hospitality sector has been performing well in the Kingdom, especially in Riyadh, and is expected to further improve during the remainder of the year.

With the Kingdom’s economic momentum expected to continue well through 2022 on the back of an anticipated increase in oil production, the country report forecasts that the real estate sector will show further stability with a chance of mild acceleration in the second half of the year. Solid growth in the oil sector, the growing domestic investments in non-oil sectors by the country’s sovereign wealth fund Public Investment Fund, stronger private consumption, and an increase in religious tourism due to the easing of travel restrictions are expected to remain

major positive drivers for the economy and the real estate sector. On the other hand, rising interest rates, which are expected to have a negative effect on mortgage