Chairman of Rao Holdings , Mr Ali Shamsher Rao, tells CBNME how lower mortgage interest rates and higher loan-to-value ratio make it a buyer’s market

To understand where the roots of this theory lie, it is essential to zoom out and rewind a little to the state of Dubai’s property market before the COVID-19 pandemic curbed a majority of economic activity globe. Demand for housing in Dubai was already rising ahead of the current crisis, and residents mostly drove it. Reports state that the number of home sales recorded with the government during fall in 2019 soared to their highest level in over 15 years, and activity remained abuzz well into the first quarter of 2020 before the pandemic hit the region.

In fact, some upmarket neighbourhoods like Dubai Marina even recorded an ever-so-slight price increase for the first time in many years. For instance, Al Barsha South Fifth recorded 48 transactions for the sale of flats in the last quarter of 2019. Even though the pandemic had hit Dubai in January itself, the corresponding number for the first quarter of 2020 is 61*. The number of land mortgages saw a spike from 1393 in Q4 2019 to 1781 in Q1 2019*, indicating the industry’s improving condition.

The thing is that the buyer sentiment was high, before this unexpected turn of events with COVID-19 – people who have been here for over half a decade had surely made up their minds to buy a property, and some were in the process of looking to buy already. This is further proven by the fact that since the lockdown restrictions were eased in May, house hunting and purchasing have already started to make their return.

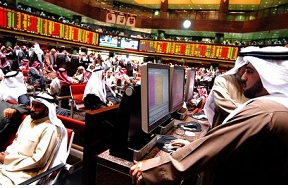

Look at things from a prospective buyer’s point of view – pretty much everything is going in their favour. With lower mortgage interest rates, higher loan-to-value ratio reduced service charges, and best of all, lucrative valuations, there’s every reason for this to be a buying opportunity. For those buyers whose cash flows and buying decisions have not been affected during this crisis, this is, after all, a golden opportunity. Lower entry price points and attractive interest rates come together to lower the price. Add to it the favourable loan-to-value ratio resulting from the increase of five percentage points for first-time buyers. These factors have considerably enhanced affordability in the secondary sales mortgage market.

Moreover, several developers are also offering incentives and gifts like service charge waivers for a certain period and free kitchen appliances and gadgets. These act as added incentives for buyers as they become a kind of expense saved in a slow market. Altogether, this makes for an incredible opportunity for cash-rich purchasers who were already planning to invest in property. This is a window of time to take advantage of the current subdued market conditions to build your wealth as prices pick up and rise.

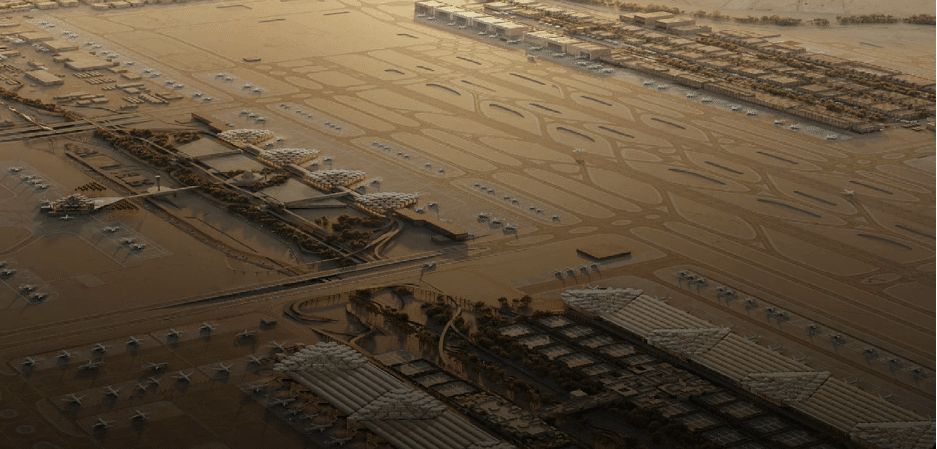

As local buyers have a number of factors going in their favour, so do international buyers with many fundamentals to their decision-making remain unaffected by COVID-19. Essential elements such as the climate, the tax benefits here supported by limited transactional cost, along with leisure amenities and high returns make Dubai and most of the UAE an appealing investment opportunity to the international investor base. The international buyer who wants to become a local has a set of incentives, too. The very thoughtful leadership of the country has implemented a set of reforms that have both indirectly and directly had a positive impact on Dubai’s property market.

In 2019, Dubai started offering long-term visas for specific categories of residents, creating an entire subcategory of affluent expatriates. They are looking to put down roots in the world-class city. A large number of potential buyers who wish to make the transition from renting to owning and the new reforms support that. The rulers have lengthened the visa for qualifying property investors to 10 years, attracting a lot more direct investment through this route than before.

Moreover, the government recently made mortgages more accessible to first-time buyers, so the effect of that is going to be more buyers, too. Both expatriates and Emiratis purchasing their first home can now finance up to 80% and 85% of their purchase, respectively (up from 75% and 80%). This reduces the funds required to make the down payment for a property. For example, the land mortgage transactions jumped from 198 to 281 in Nadd Hessa between Q4 2019 and Q1 2020*, as more people began to avail the option.

As restrictions ease up further and things get back to a new normal, buyers will multiply, and the next housing cycle could look entirely different from what it does now, marking the steady and sustainable price rise.

*All statistics taken from https://dubailand.gov.ae/en