United States, China, Brazil and India are expected to keep world government debt rising this year, Standard and Poor’s said on Monday, despite a small reduction in the annual global borrowing bill.

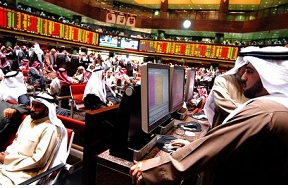

Total government debt in the Middle East and North Africa, including the Gulf Arab states, is set to grow to US$667 billion by the end of this year, a rise of 15 per cent compared with last year, S&P said in a new report. 13 MENA sovereigns will borrow an equivalent of US$134 billion from long-term commercial sources in 2016. This compares with total commercial borrowing of US$143 billion in 2015.

The rating agency said saying the stock of global government debt was expected to rise 2 percent to US$42.4 trillion, with new borrowing of US$6.7 trillion set to continue to outstrip the amounts being repaid.

Gulf debt issuance will grow to US$45 billion this year, up from US$40bn last year, according to the ratings agency.

The majority of new debt will come from Saudi Arabia, which will issue US$31bn in new debt this year, S&P estimates. The country sold US$27bn in local debt last year A number of major countries are behind the underlying trend.

U.S. borrowing is expected to increase 8 percent or US$163 billion year-on-year, while world number two economy China is forecast to ramp its borrowing 18 percent or US$51 billion.

The rise in China and in the likes of Brazil and India is set to drive year-on-year emerging market borrowing up 9.4 percent or US$587 billion and lift the total EM total debt stock to US$6.8 trillion by the end of the year. Today, Reuters reported that China aims to lay off 5-6 million state workers over the next two to three years as part of efforts to curb industrial overcapacity and pollution, Beijing’s boldest retrenchment programme in almost two decades.

S&P said it saw the biggest absolute increase in annual borrowing in Brazil, which it expects will borrow US$14 billion more in 2016 an increase of 8 percent.

Poland and India are both forecast to see US$12 billion increases which is an 38 percent rise for the former and 8 percent increase for the latter.

In contrast, Japan, the euro zone and others such as Canada, the UK, Mexico and Ukraine are expected to see year-on-year drops in headline borrowing numbers.

The euro zone is expected to see a near 6 percent drop, although its overall debt stock will also continue to creep up to just over 7 trillion euros as its countries borrow more than they repay.

Globally annual issuance is forecast to dip to US$6.745 trillion from US$6.899 trillion in 2015, though with US$4.9 trillion maturing, the US$1.7 trillion ‘net’ increase will keep the overall debt stock rising.

Source : WAM