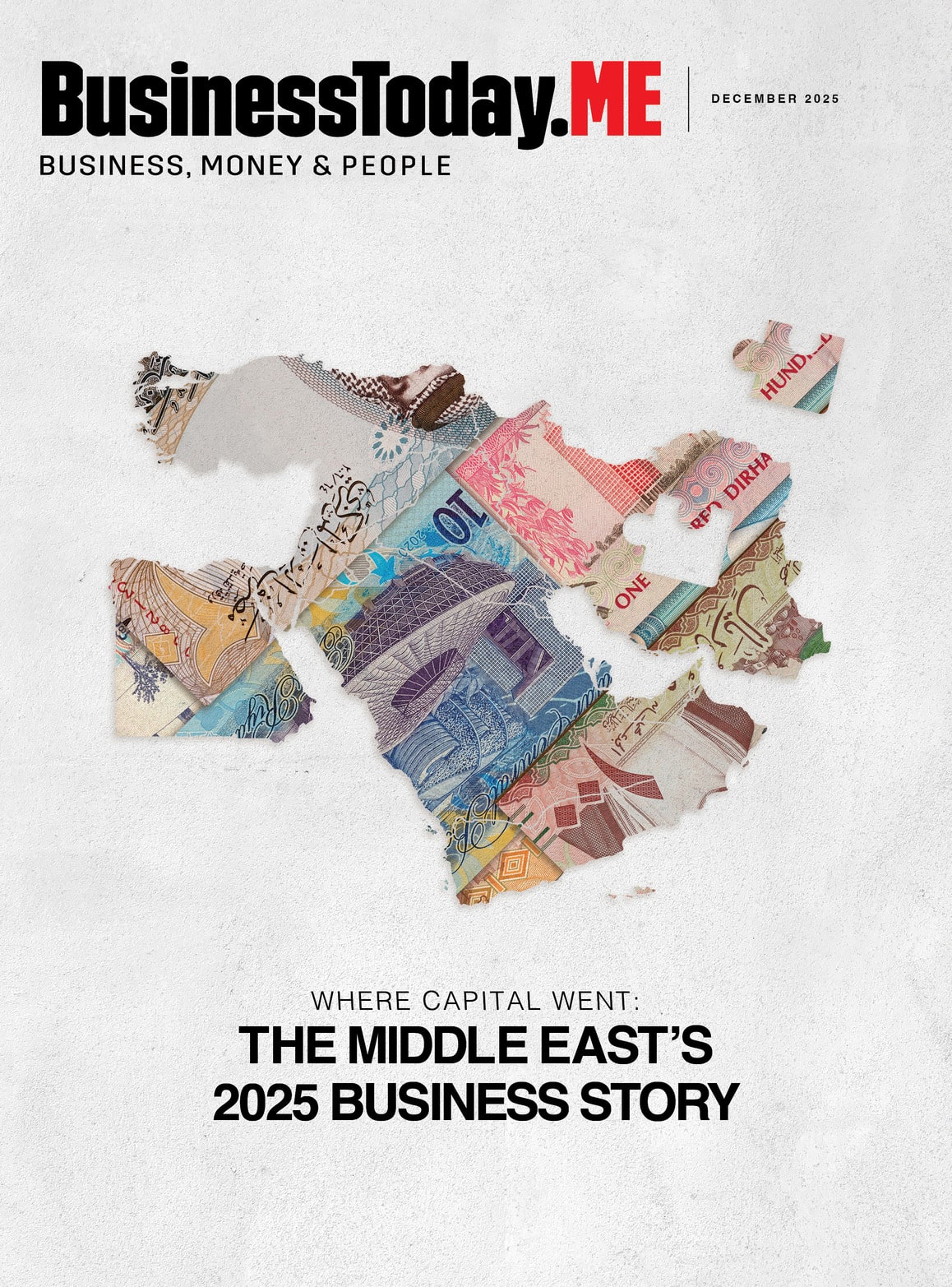

• Residential transaction activity in Dubai continued to grow robustly in 2022, up 51% between January and November exemplifying the emirate’s safe-haven status

• A combination of strong business conditions and limited availability of good quality office spaces were broadly responsible for double-digit growth in rental values, lifting them to levels previously seen in 2015

• Occupancy rate for Dubai’s hotels climbed to 72% over January-November 2022 while Abu Dhabi’s occupancy rate climbed to 69% in the first 11 months of last year

• Delivery of around 200,000 sq. m. of retail floorspace last year raised Dubai’s total stock to 4.63 million sq. m with about 355,000 sq. m of space scheduled to be delivered in 2023 across the city.

Despite macroeconomic volatilities impacting the global real estate landscape, the UAE witnessed strong momentum in the last quarter of 2022, signaling a steady growth pipeline in 2023. In the same context, JLL’s UAE 2022 Year in Review report offers a rear-view mirror perspective of 2022 while underlining the opportunities that lie ahead in the year.

Faraz Ahmed, Associate, Research at JLL MENA, said: “2022 has been a year of sustained growth for the UAE’s real estate sector as it continued to gather pace while benefiting from the country’s reliable economic policies, excellent infrastructure, safe haven status, and innate ability to adapt to new trends. Even segments like retail that faced headwinds initially in the year, recovered significantly in the last quarter. Looking ahead, we can expect the UAE to continue to attract the attention of both regional and international investors with aspirational offerings within the sector.”

The residential sector emerged as the outperformer

Residential transaction activity in Dubai continued to grow robustly last year. Data from Dubai Pulse further demonstrates that transaction volumes in the emirate were up 51% between January and November 2022 while the value of transactions rose by 55%. Anecdotal evidence suggests that the jump can be largely attributed to the spike in demand from foreign buyers.

In addition, the delivery of 38,000 residential units last year pushed Dubai’s total supply to 680,000 units whilst, in Abu Dhabi, the delivery of roughly 6,000 units brought the capital’s residential stock to 279,000 units. In 2023, the level of scheduled completions will be a little higher (41,000 units) in Dubai and the capital is slated to see the planned completion of 6,000 units.

In annual terms, average residential sales prices were up 10% and 3% in Dubai and Abu Dhabi, respectively, in Q4 2022. Though rents in Dubai grew by 27% over the same period, they largely remained flat in the capital.

The standout performance of the residential sector once again exemplifies Dubai’s relative safe-haven status against the background of prevailing geopolitical and economic challenges in the world. That said, the strong residential activity can also be partly attributed to prices continuing to look attractive in comparison to other major cities around the globe.

On the back of increased demand, the pipeline of projects announced by developers in 2022 grew to 27,000 units; these will be delivered over the coming years. However, it is worth noting that investors and end-users are generally making more informed decisions and are more selective when considering which properties to purchase. Therefore, developers need to differentiate their products from competitors and deliver units of a better standard.

After a prolonged downturn in Dubai office rents, the sector saw a remarkable turnaround last year

Grade A rents in Dubai’s CBD increased by 21% year-on-year in Q4 2022, to an average of AED 2,100 per sq. m. per annum. Meanwhile, healthy leasing activities in Abu Dhabi have largely supported the 8% annual increase in Grade A rents to an average of AED 1,790 per sq. m. per annum. Furthermore, rising office demand and inadequate new completions translated into lower levels of availability in both cities. In the last quarter, vacancy rates in Dubai and Abu Dhabi fell to 11% and 23%, respectively.

Last year, the technology, finance, defense, and other professional services industries accounted for a large share of enquiries. The segment also witnessed a steady influx of new entrants, pushing up aggregate occupier demand, and leading to landlords offering fewer incentives.

Moreover, the scarcity of well-managed, Grade A office space is causing occupiers to consider less expensive buildings and locations, presenting an opportunity for owners of Grade B assets to potentially capture the “spill-over” of demand for good-quality floorspace by upgrading their existing space.

Overall, in 2022, the stock of office space in Dubai rose by 30,000 sq. m. to reach 9.1 million sq. m. whereas an addition of around 8,000 sq. m. in Abu Dhabi increased the capital’s total stock to 3.9 million sq. m. In 2023, almost 100,000 sq. m. of office floor space is expected to be delivered in Dubai and over 35,000 sq. m. in Abu Dhabi, respectively.

Rebounding tourism underpinned the growth of the hotel sector

According to Dubai Economy and Tourism (DET), the emirate received 12.82 million overnight visitors between January and November 2022. Although still 15% (approx.) below pre-pandemic levels, it represents a significant increase over the equivalent period in 2021 (6.02 million). Furthermore, additional data from DET indicates that while visitors from the top ten source markets are broadly approaching pre-pandemic levels, China was an exception in the first 11 months of 2022. While this can be attributed to the country’s zero-COVID policy, the recent relaxation of rules should provide a boost to tourist numbers from the country going forward.

With the completion of around 6,800 keys in 2022, Dubai’s hotel stock rose to 148,000 with most deliveries comprising 4 & 5-star properties and the addition of 600 keys raised the total supply of hotel & hotel apartment keys to over 32,000 keys in the capital. In the forthcoming year, approximately 13,000 keys are scheduled to be added in Dubai while Abu Dhabi will see an expected delivery of an additional 400 keys.

The occupancy rate for Dubai’s hotels climbed to 72% over January-November 2022, a strong improvement compared to last year (63%). Simultaneously, the city’s average daily rate (ADR) rose by 22% year-on-year to USD 184. Meanwhile, Abu Dhabi’s occupancy rate climbed to 69% in the first 11 months of last year (up from 66% in the corresponding part of 2021) and ADR jumped by 29% to USD 119.

Lastly, several hotels in both Dubai and Abu Dhabi reported full occupancy towards the end of last year as demand skyrocketed on the back of the Formula 1 event in the UAE’s capital and the FIFA World Cup in Doha.

The retail sector witnessed signs of redemption in the second half of 2022

The sustained rise of online shopping has led retailers to strengthen their digital presence to further bolster revenues in an increasingly competitive environment. Although snarled supply chains and inflationary pressures were highlighted as key headwinds by market players last year, there were signs of easing in the second half.

The delivery of around 200,000 sq. m. of retail floorspace last year raised Dubai’s total stock to 4.63 million sq. m with about 355,000 sq. m of space scheduled to be delivered in 2023 across the city – a new super-regional mall and the expansion of two existing ones in the same category will account for the majority of it. In the capital, however, the retail stock remained unchanged in 2022 at 2.89 million sq. m but is expected to increase by 232,000 sq. m this year.

After trending down in recent years, rents have broadly stabilized across both cities. In Q4, average rental values across primary & secondary malls in Abu Dhabi were flat when compared with the corresponding part of 2021 while rents in Dubai edged down by 1%. However, it is important to note that well-located super-regional malls have benefited from returning tourists, leading to the growth in rents for this section. Average rents for super-regional malls in Dubai rose by 3% year-on-year in the last quarter of 2022, compared with Q4 in 2021.

Overall, to differentiate their offerings, owners and franchise operators remained focused on bringing unique entertainment concepts to drive footfall. What’s more, landlords have been offering favorable lease terms and incentives to attract new international brands, especially in the F&B segment.