JLL reports approximately 10,000 residential units delivered in Dubai and 1,600 in Abu Dhabi

The introduction of innovative product offerings, attractive payment options and recent updates to the Golden Visa requirements continue to drive investor demand within the country’s residential market, according to JLL’s UAE Real Estate Market Overview for Q1 2024.

The residential market in Dubai experienced a strong start to the new year, with approximately 10,000 residential units completed throughout the first quarter, raising the total stock to 729,000 residential units. Over the remaining 9 months, an additional 25,000 residential units are scheduled for delivery in the emirate, primarily consisting of apartments located in prominent areas such as MBR City, Business Bay, Jumeirah Village and Dubai Land. In Abu Dhabi, there was a steady delivery of 1,600 residential units with 6,000 residential units expected to be added by the end of the year.

Faraz Ahmed, Research Director at JLL MENA, said: “During the first quarter, the residential sector continued to demonstrate strong growth. Dubai’s residential sales transactions recorded a 20% increase in volume compared to the same period last year, whereas Abu Dhabi witnessed a 17% increase in volume, with more apartment transactions than villas and townhouses. However, escalating land prices and construction costs are compelling developers to shift their focus towards secondary locations in addition to targeting properties within the AED 2 million price range, enabling buyers to meet the threshold for the Golden Visa eligibility.”

In Dubai, both residential sale prices and rentals registered around 21% annual increases, respectively. Apartment rentals, in particular, experienced a considerable annual surge of 22%, surpassing the growth rate of villa rentals at 14%. Demand for villas remained robust, with a notable uplift of 22% y-o-y in sale prices. In Abu Dhabi, residential sales prices increased by an average of 7%, while rental rates rose by an average of 4% during the same period. Similar to Dubai, apartments in Abu Dhabi recorded higher rental hikes of 5% compared to villas. However, in terms of sale prices, villas in Abu Dhabi grew by 9% y-o-y.

Healthy tourism activity sustains hospitality sector’s growth

In Dubai, new hotel openings predominantly consisting of 5-star properties located in areas such as Business Bay, Za’abeel, and Port Saeed saw the addition of nearly 2,000 keys during Q1 2024, bringing the total to approximately 155,000 keys. Another 5,000 keys, consisting of both 4- and 5-star properties, are expected to be added in the emirate through the year. In contrast, Abu Dhabi’s hotel supply remained relatively stable at 32,500 keys, and an additional 500 keys are anticipated to be added during the year.

According to Dubai’s Department of Tourism (DET), the city welcomed 3.67 million visitors in January and February, reflecting a notable 18% increase compared to the previous year. Western Europe, South Asia and the GCC emerged as the largest source markets, collectively accounting for 53% of the total share. These healthy tourism figures helped sustain a 5% growth in average daily rates (ADR), reaching USD 226, resulting in revenue per available room (RevPar) increasing 5% y-o-y, reaching USD 185.

Abu Dhabi’s hotel performance has been influenced by robust tourism demand, a diverse calendar of events, and improved connectivity. For YT March 2024, city-wide occupancy was recorded at 81%, and ADR increased by 8% y-o-y to reach USD 161. Additionally, RevPAR experienced significant growth, rising by 17% to reach USD 130 when compared to the same period last year.

Given the significant presence of luxury hotels, owners and operators in the hospitality industry are aware of the competitive advantage offered by experience-driven developments. Operators are investing in revitalising their product offerings to enhance their value propositions through partnerships with lifestyle groups, which facilitate the introduction of new concepts and brands, particularly within the highly lucrative F&B segment.

Landlords in the office market prioritise long-term occupancy and flexible spaces

The office market in Dubai witnessed limited delivery of around 17,000 sq. m. of new office space during the first quarter, resulting in a total stock above 9.2 million sq. m. For the remainder of the year, around 38,000 sq. m. of space is expected to be delivered.

Whilst Dubai’s upcoming supply for the year remains limited, materialisation of previously announced expansion plans of existing freezones and commercial developments is expected to gradually alleviate supply pressure in the long run. In Abu Dhabi, supply remained stable at 3.94 million sq. m. during the quarter and has an additional 79,000 sq. m. scheduled for 2024.

Demand for office space continued to remain strong with notable activity from corporate occupiers, who showed a preference for fitted space due to landlords’ reduced contributions to capital expenditures (CAPEX). Tenants continued to face challenges in securing favourable lease terms due to limited availability, high rents, and intense competition, especially within the Central Business District (CBD).

From a landlord’s standpoint, the current strategy involves prioritising long-term occupancy and employing a selective approach when signing tenants. Assessing their value-add to the building and compatibility within the existing tenant mix were key considerations. Moreover, landlords have recognised the advantages of integrating flexible space components into their developments to accommodate a diverse range of office needs. This is particularly beneficial for new market entrants with small office space requirements that may subsequently expand.

As a result, rental rates in both cities’ office markets experienced a significant upsurge in Q1 2024. Average Grade A rents in Dubai’s CBD increased by 22% year-on-year (Y-o-Y), reaching AED 2,600 per sq. m. per annum. The spike in leasing activity further decreased office vacancies within the CBD, from 11% a year ago to the current 8%. Similarly, average city-wide Grade A rents in Abu Dhabi increased by 14% during the same period, reaching AED 2,045 per sq. m. per annum. Additionally, average city-wide vacancy stood at 22% in the capital.

Community malls and concepts driving the retail sector’s performance

Due to the limited availability of space within prime super regional malls, local brands and home-grown concepts are focusing on smaller community malls, which is driving boutique retail developers to consider developing small community concepts in prominent locations, specifically tailored to accommodate exclusive brands.

To remain competitive, owners in Dubai are considering refurbishment and redevelopment projects for existing malls, as well as introducing innovative experiential concepts to drive footfall. Meanwhile, in Abu Dhabi, retail developers are prioritising innovation to avoid redundancy in the tenant mix and enhance the overall retail experience. Additionally, both markets are aligning with technology and e-commerce trends to deliver enhanced online and offline shopping experiences for customers.

In Q1 2024, approximately 12,000 sq. m. of retail gross leasable area (GLA) was completed in Dubai, keeping the total existing stock largely unchanged at 4.8 million sq. m. During the year, another 104,000 sq. m. of new retail space is expected to be delivered. In the capital, while no significant retail projects were completed, around 17,000 sq. m. of retail GLA is expected to be delivered within the year.

Strong demand outpaces supply in the industrial market

The new India-UAE trade agreement coupled with the development of an upcoming warehouse, Bharat Mart, has successfully maintained Jebel Ali Free Zone (JAFZA) as a well-established free zone for international trade in the UAE. As a result, warehouse rents in JAFZA witnessed a significant 26% annual increase, reaching an average of AED 365 per sq. m. per annum.

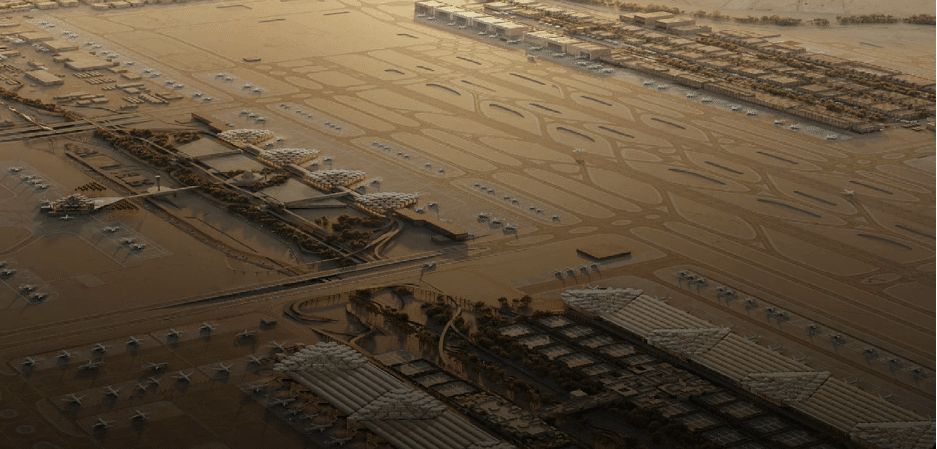

Recognising the growing demand for quality industrial stock, developers are actively addressing the supply shortage through partnerships such as the one between Dubai South and Aldar to develop Dubai South’s Logistics District. The plans for this venture involve the construction of a Grade A build-to-lease logistics facility, encompassing approximately 24,000 sq. m. of gross floor area (GFA), with a targeted completion date of the end of the year.

Abu Dhabi’s industrial market sustained robust demand in the first three months of 2024, benefiting from strong growth in the non-oil sector and the expanding e-commerce market. Rental rates across major submarkets experienced a notable increase in the industrial sector, with growing spillover demand from Dubai driven by the limited availability of vacant Grade A spaces in the latter city.

The strategic location and connectivity of industrial areas such as Khalifa Economic Zones Abu Dhabi (KEZAD) and the Industrial City of Abu Dhabi (ICAD) attracted heightened demand from tenants across various categories. Warehouse rents in ICAD saw an annual increase of 6%, reaching AED 370 per sq. m. per annum, while rents in KEZAD rose by 5%, reaching AED 400 per sq. m. per annum. The presence of Grade A supply in KEZAD positions it favourably as a prime location for tenants seeking high-quality warehouse space.